tax sheltered annuity vs 403b

You can contribute as little as 15 per month or as much as 100 of your eligible compensation up to 20500 for 2022 in the UTSaver TSA Traditional and Roth combined. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations.

These retirement accounts are typically offered by.

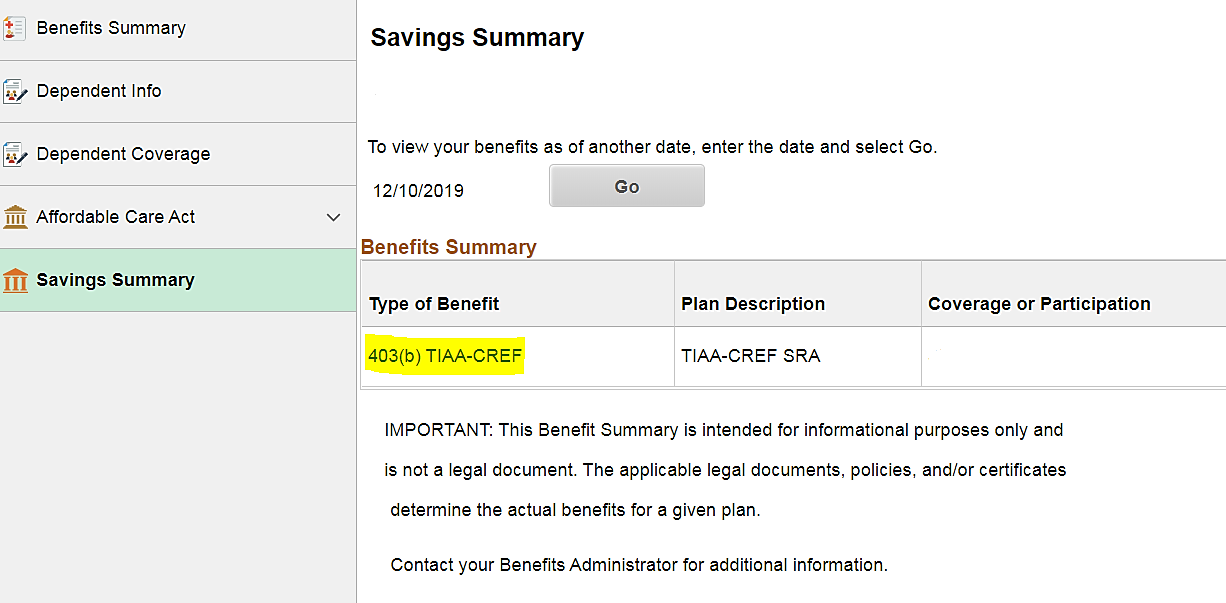

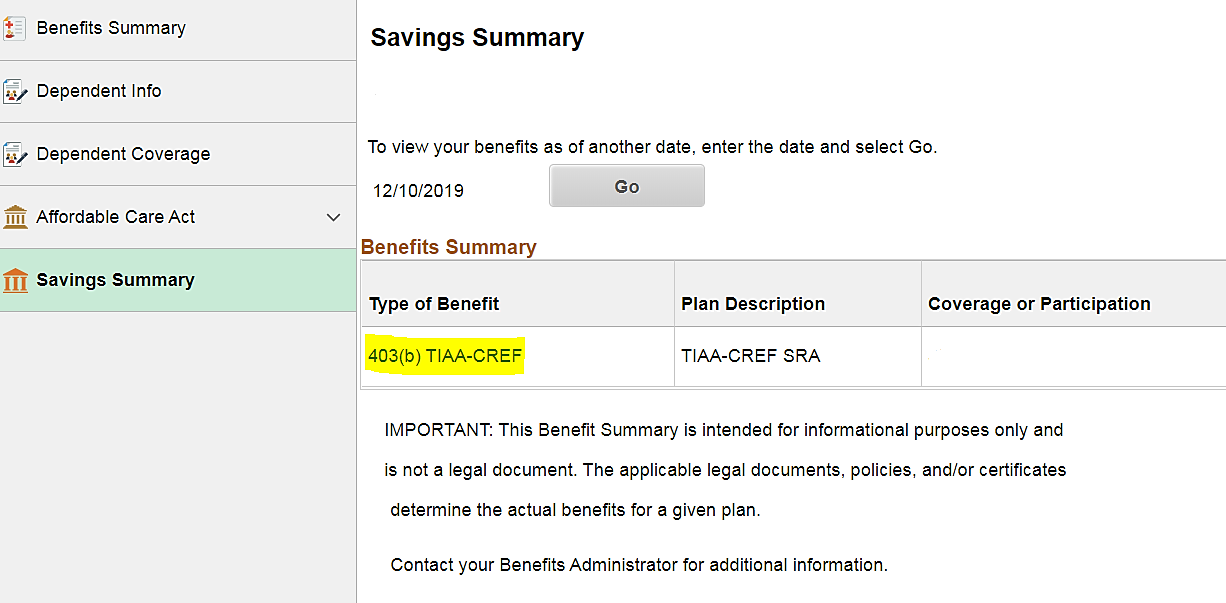

. Fidelity Professionals Are Here to Help You Determine Your Retirement Plan Goals. The main difference between a 401 k and a 403 b plan is based on where you work. The UW 403 b Supplemental Retirement Program SRP formerly the UW Tax-Sheltered Annuity TSA 403 b Program allows employees to invest a portion of their income.

Contribution limits for 403 b plans are the same as for 401 ks. What is a tax-deferred annuity plan. Ad 11 Tips You Absolutely Must Know To Find The Best Annuities.

Ad Schedule an Appointment With Fidelity To Help Determine Your Retirement Goals. Ad Flexible Planning That Allows You to Adjust as Your Needs Change. A 403 b plan is a type of employer-sponsored retirement plan.

A 403 b plan will be offered by certain tax-exempt nonprofit organizations. 403 bs that provide for vesting. Sometimes a TDA plan is also.

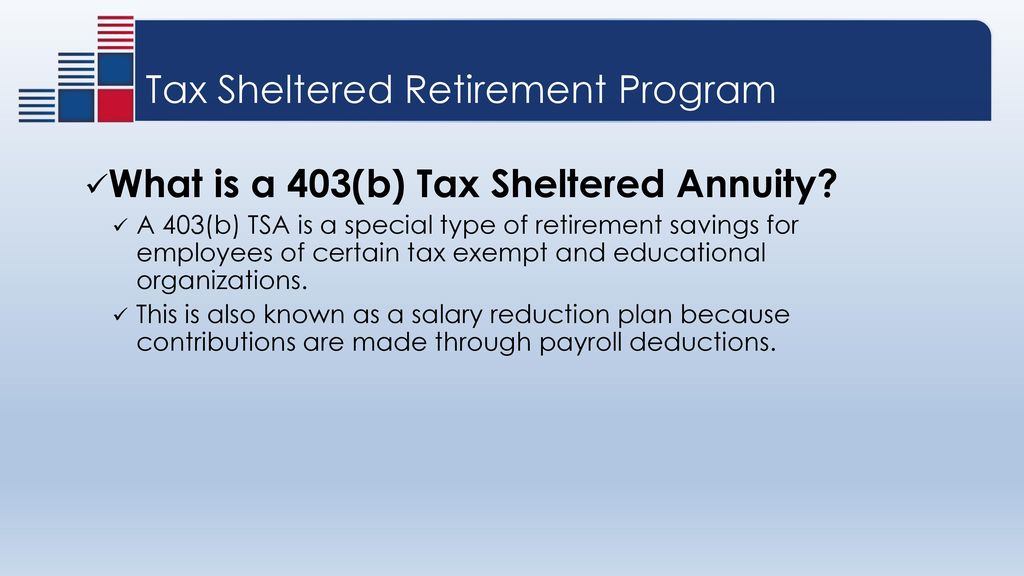

Lets Face the Future Together. Tax Sheltered Annuity 403b Deferred Compensation 457 General Description A retirement income vehicle which allows eligible employees to defer taxation savings to future years. A 403 b plan also known as a tax-sheltered annuity TSA plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and certain.

A tax-sheltered annuityalso known as a 403 b plan or a TSA planis a type of retirement plan only offered by certain 501 c 3 tax-exempt organizations such as charities. Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios. 401 k plans can choose from a wider range of.

Fidelity Professionals Are Here to Help You Determine Your Retirement Plan Goals. Employees can have their employers defer portions of their pay to these retirement accounts so that these. The main difference between a 401 k and a 403 b plan is the menu of investment choices available to employees.

Ad Schedule an Appointment With Fidelity To Help Determine Your Retirement Goals. A 403 b plan. According to the IRS the annual contribution limit is 19500 in 2021 and rises to 20500 for 2022.

A 401 k plan will be offered. A 403b is an employer-sponsored retirement savings account sometimes also called a TSA tax-sheltered annuity plan. Ad Wide Range of Investment Choices Access to Smart Tools Objective Research and More.

Get this must-read guide if you are considering investing in annuities. Equitable Financial Life Insurance Company NY NY. Withdrawals from the plan are.

A tax-deferred annuity TDA plan is a type of retirement plan designed to complement your employers base retirement plan. Age 50 catch-up applies only after the 402 g 1 employee elective deferral limits and 402 g 7 15 years-of-service catch-up dollar limitations. Employee contributions which are payroll deducted into a TSA 403 b tax plan are generally made on a pre-tax basis and are allowed to grow tax-deferred.

A 403 b plan also known as a tax-sheltered annuity plan is a retirement account available to certain employees including public school teachers and nonprofit workers.

The Importance Of Saving For Your Retirement Ppt Download

Qualified Vs Non Qualified Annuities Taxation And Distribution

Business And Finance 403 B Tax Sheltered Annuity Documents

403b Vs Roth Ira Which Retirement Plan Suits You The Best Wealth Nation

403 B Tax Sheltered Annuity Plan Overview Vermillion Financial Advisors Inc

Update Tax Sheltered Annuity Contributions Online Human Resources Uw Madison

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax Sheltered Annuity Definition

403 B Tax Sheltered Annuity Plans Tsa S Longmeadow Ma

403 B Plan The Tax Sheltered Annuity Updated Guide Smartasset

Tax Sheltered Annuity Faqs Employee Benefits

403b Tsa Annuity For Public Employees National Educational Services

The Tax Sheltered Annuity Tsa 403 B Plan