are property taxes included in mortgage in texas

The loan is secured on the borrowers property through a process. Until we reckon with our compounding moral debts.

Deducting Property Taxes H R Block

Does not apply to a real estate mortgage lienholder who.

. Added by Acts 2001 77th Leg ch. Create a Living Trust in Texas. Sixty years of separate but equal.

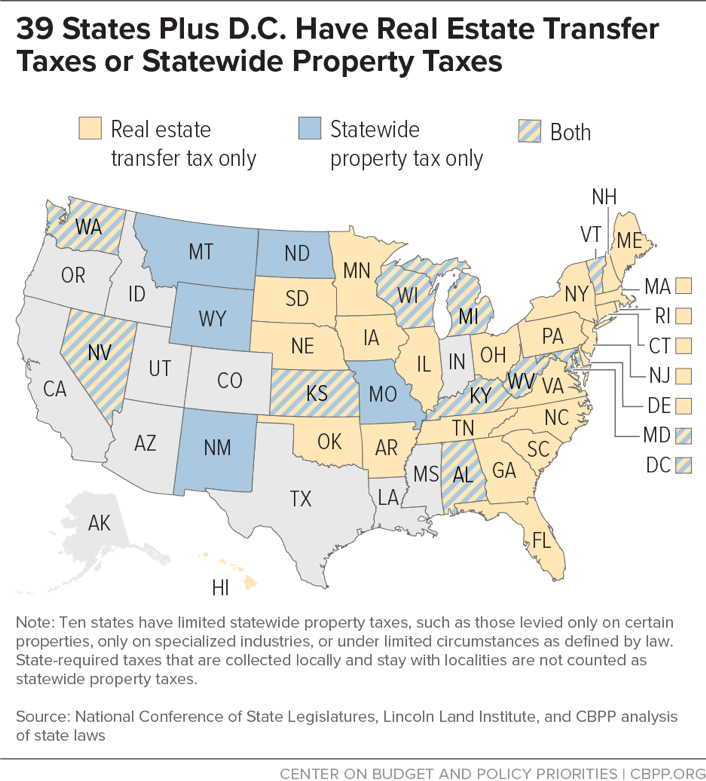

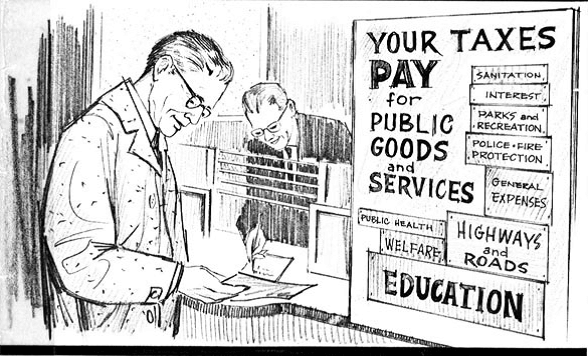

Because real estate purchases all boil down to the actual agreement who actually pays property taxes when a house is sold depends on the language in the contract. For example New Jersey has the highest average effective property tax rate in the country at 242. Property taxes fund things like public schools roads and fire departments.

A An estate in land that is conveyed or devised is a fee simple unless the estate is limited by express words or unless a lesser estate is conveyed or devised by construction or operation of law. 555 for more information about community property laws. About one-third of county property taxes go to schools with rates varying based on district.

Spouses in Texas Inheritance Law. ASCII characters only characters found on a standard US keyboard. There is a fee for seeing pages and other features.

In Texas you dont have to go the traditional marriage route to be considered. Heres how all 50 US states stack up. The state repealed the inheritance tax beginning on Sept.

Ninety years of Jim Crow. Reuters the news and media division of Thomson Reuters is the worlds largest multimedia news provider reaching billions of people worldwide every day. Property taxes vary widely from state to state and even county to county.

Heres how to do that math by the way. Must contain at least 4 different symbols. To pass your property on to beneficiaries cost-effectively when you die consider combining a revocable trust with an LLC.

The average rate on the 30-year fixed mortgage edged up to 694 from 692 last week according to Freddie Mac. And one potentially large amount of cash due is property taxes that are included in closing costs. C Unless otherwise provided by a mortgage instrument or deed of trust in case of foreclosure of a mortgage tax sale judicial sale sale by a trustee under a deed of trust or sale under Bankruptcy Code or receivership proceedings of a unit owned by a declarant or of real property in a condominium subject to development rights a person.

2018 State Local Property Taxes Per Capita. Reuters provides business financial. As a result the data exclude property taxes paid by businesses renters and others.

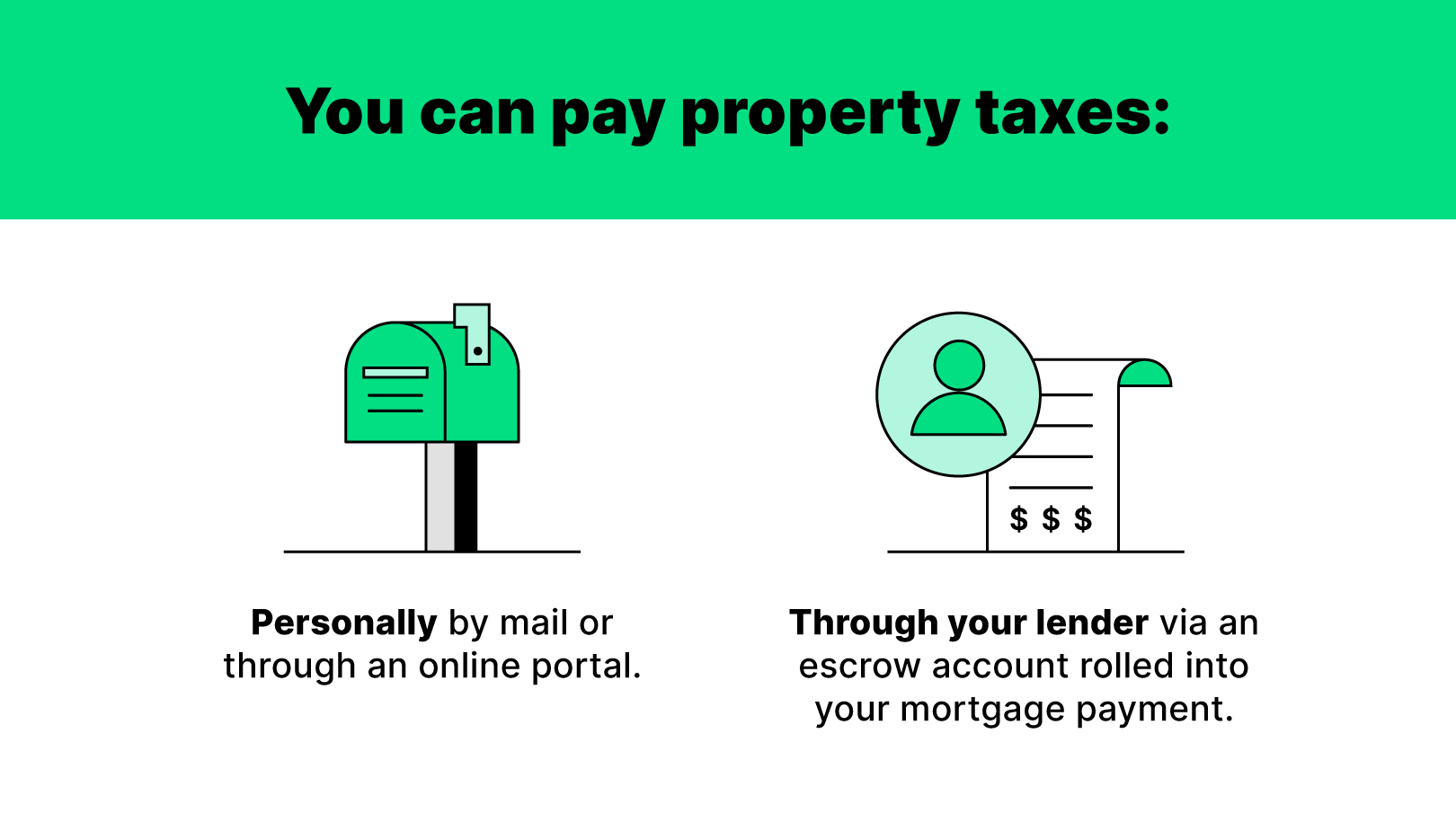

Any limitations on meetings by tenants in the common area facilities must be included in the manufactured home community rules. Total property taxes in Madison County range from 37 mills in rural areas those that are not a part of any municipality to 580 mills in Huntsville. Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest.

There are no inheritance or estate taxes in Texas. Your lender might require you to pay up to a years worth of property tax dues at closing. Owning property in Wyoming however will only put you back roughly 057 in property taxes one of the lowest average effective tax rates in the country.

Why Its So Important. This figure includes a mortgage payment as well as insurance costs property taxes utilities and HOA fees where necessary. States with community property laws include Arizona California Idaho Louisiana Nevada New Mexico Texas Washington and Wisconsin.

6 to 30 characters long. In District 1 which includes all areas outside of Huntsville the school millage rate is 160. 10 surprisingly affordable lake towns to own property in.

Vehicle insurance may additionally. Vehicle insurance also known as car insurance motor insurance or auto insurance is insurance for cars trucks motorcycles and other road vehiclesIts primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Keeping you informed on how to handle buying selling renting or just nesting at home as we adapt to life during COVID-19.

Two hundred fifty years of slavery. Land and anything fixed to it such as a homestead is real property. Mississippis property taxes are also generally low.

At 089 Florida is slightly below the national average property tax rate of 111 and Texas is seventh highest in property tax rates at 18. Vehicles investments and memorabilia. Check out our latest property taxes by state report and find out which states have the highest or the lowest property taxes in the US.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. You can estimate your property taxes using public records and your appraisal value. See how your monthly payment changes by making updates to.

Thats 167 per month if your property taxes are included in your mortgage or if youre saving up the money in a sinking fund. Texas AG sues. The amount youll pay in property taxes depends on where you live and your homes value.

Census Bureau 2019 American Community Survey. However Mississippi retirees should watch out for the relatively high state sales tax rate of 7. A change in your reporting position will be treated as a conversion of the entity.

May 26 2022 3 min read. Papers from more than 30 days ago are available all the way back to 1881. E If the organization that owns improved or unimproved real property that has been exempted under Subsection a sells the property to a person other than a person described by Section 2306786b1 Government Code a penalty is imposed on the property equal to the amount of the taxes that would have been imposed on the property in each tax.

Median real estate taxes are just 1009. 200000 x 1 tax rate 2000 taxes owed. MANUFACTURED HOME TENANCIES.

DCs rank does not affect states ranks but the figure in parentheses indicates where it would rank if included. But one of the important changes is that owners are. Thirty-five years of racist housing policy.

Paying Your Property Taxes Willow Bend Mortgage

Is Property Tax Included In My Mortgage Moneytips

Why Are Texas Property Taxes So High Home Tax Solutions

How Do I Pay Property Tax In Texas

Is Property Tax Included In My Mortgage Moneytips

City Of Alamo Texas Emergency Mortgage Assistance Facebook

How To Use A Mortgage Calculator With Taxes In Texas

What Am I Paying For With My Monthly Mortgage Payment

New Funds Available To Texas Homeowners Facing Foreclosure The Senior Source

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Property Tax Calculator Smartasset

What Is Escrow And How Does It Work Texas United Mortgage

Property Taxes By State Highest To Lowest Rocket Mortgage

Your Guide To Property Taxes Hippo

The Value Of Your Travis County Home Has Gone Up A Lot That Doesn T Mean Your Property Taxes Will Kut Radio Austin S Npr Station

The Community Press Homeowner Assistance Starting Today The Texas Homeowner Assistance Fund Program Has Begun Accepting Applications To Help Qualifying Homeowners Who Have Fallen Behind On One Or More Of The

7 Things You Need To Know About Your Property Taxes City Of Round Rock

2022 Property Taxes By State Report Propertyshark

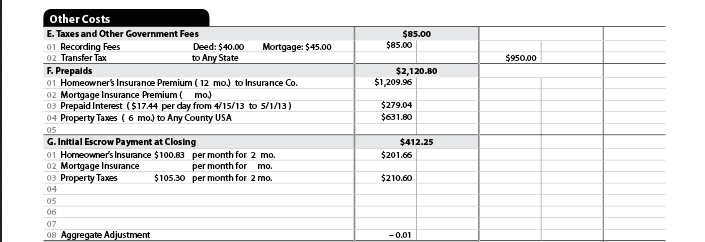

Understanding Prepaids Impounds On Closing Disclosure Mortgage Blog